When it comes to tracking income and expenses, every small business reaches the same fork in the road: should it keep or transition its accounting method? There are two main accounting methods for small business: cash and accrual basis accounting. Each has its advantages and disadvantages, but whichever one you choose will impact your tax liability, financial statements and decision making. Settle the debate over accrual vs. cash basis accounting, so you can decide which one fits the needs of your business best.

What Is Cash Basis Accounting?

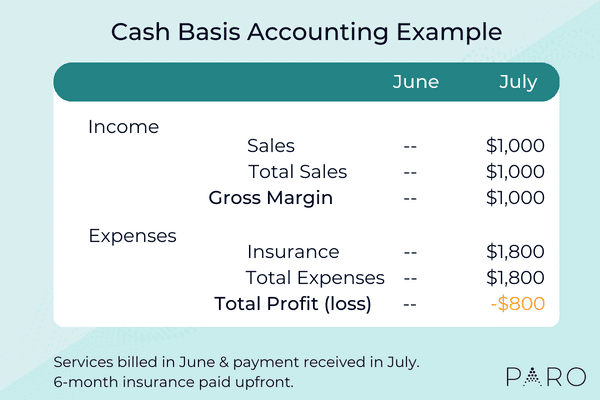

Cash basis accounting is a method of recording revenues and expenses when cash is actually received or paid out rather than when they are earned or incurred. In other words, this accounting practice involves logging financial gains or losses in real time—similar to how you would balance a checkbook.

What Is Accrual Basis Accounting?

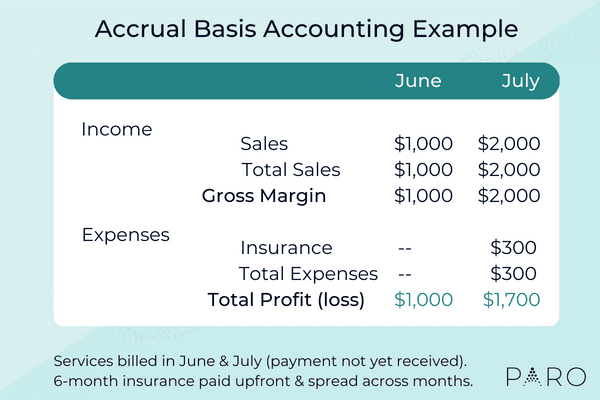

Accrual basis accounting differs from the cash method by tracking income and expenses as they are billed or earned, regardless of when the cash is actually received. This provides small businesses with a much more holistic view of their financial health and shows exactly how much they earned and spent within a specified time period.

Accrual vs. Cash Basis Accounting: Which Method Should You Choose?

The key difference between cash and accrual basis accounting is timing. Figuring out which method is right for your business will depend on several factors, including the size of your company, the nature of its operations and the industry in which it operates.

For instance, some businesses, such as those in retail or service, may be better suited for cash basis accounting because they have short payment cycles and may not need to track long-term transactions.

On the other hand, businesses that have long-term contracts, such as construction companies, may be more inclined to use the accrual method. Companies that keep a lot of inventory on hand may be required to use accrual basis accounting as well. That’s because companies selling their inventory on credit may not have their revenues and expenses recorded in the same accounting period.

Regardless of your industry, however, GAAP (Generally Accepted Accounting Principles) standards require your business to use accrual basis accounting if you generate $25M or more in revenue over three years.

The Advantages of Cash Accounting

- Simplicity: Cash basis accounting is easier to understand than accrual basis accounting, which makes it a good option for small businesses that have a lot of simple transactions.

- Lower costs: Cash basis accounting requires less record keeping and accounting resources, which can lead to lower costs for small businesses.

- Easier cash flow management: This accounting method makes it easier to track and manage working capital by providing a clear and simple picture of a company’s overall cash flow.

The Disadvantages of Cash Accounting

- Lack of accuracy: Cash basis accounting can distort a company’s financial performance as it does not accurately reflect when revenues are earned or expenses are incurred.

- Limited to certain transactions: Cash basis accounting is not applicable to businesses that offer credit.

What About Modified Cash Basis Accounting?

The beauty of cash basis accounting is in its simplicity, but that can also be its biggest weakness. Luckily, there are other, lesser-known accounting methods like modified cash basis accounting that serve as a great middle ground.

Unlike the standard cash method, the modified cash basis uses a combination of cash and accrual accounting to allow you to track short- and long-term assets. This hybrid method can be useful for businesses that have a mix of cash and credit transactions and want to track their financial performance in a way that is more accurate than cash basis accounting but not as complex as accrual. Importantly, it is not recognized by GAAP standards.

The Advantages of Accrual Accounting

- Accurate financial reporting: Accrual basis accounting provides more accurate reporting of financial performance, which can help with financial planning and decision making. Investors can also get a better view of month-to-month financials on your balance sheet.

- Improved financial analysis: Accrual accounting provides a better basis for financial analysis and comparisons between different periods, as it eliminates the distortions that can arise from cash basis accounting.

- Growth-oriented: This method of accounting for small business lets you build more complexity into your accounting, so you have fewer growing pains as you scale and reach financial maturity.

The Disadvantages of Accrual Accounting

- Complexity: Accrual basis accounting can be more complex and time-consuming than cash basis accounting, and it often requires more detailed record keeping and a thorough understanding of accounting principles.

- Taxes: You’ll be taxed on income earned or invoiced at the end of the previous tax year, even if you aren’t actually paid until January of the following year.

What About Modified Accrual Accounting?

There is also a modified version of accrual basis accounting that is commonly used in the public sector, particularly when it comes to government accounting. Under modified accrual accounting, measurable revenues like taxes can be recognized before they are actually received. However, other revenues, such as grants and donations, are recognized only when the cash is received or when the revenue is earned.

When To Transition Accounting Methods for a Small Business

It’s not uncommon for smaller businesses to start off using the cash basis method and later transition to accrual once their growth and operations reach a certain point. If you anticipate your business making this shift in the near future, here are some factors you should consider when deciding between accrual and cash basis accounting:

- Tax regulations: The IRS requires companies with over $25M in average annual revenue to use the accrual method. If you expect your small business to scale, it may be better to make the switch now.

- Audit preparation: GAAP standards (for public companies) and AICPA standards (for private companies) both require the accrual accounting method, which means that any startup or small business that currently uses cash basis will need to convert in preparation for a formal audit.

- Business needs and goals: Having a clear vision of where you want your business to be within the next few years can help you determine the type of accounting system that’s right for you.

How To Transition Your Accounting Method

The IRS requires you to use the same accounting method throughout an entire tax year. So, consider transitioning in the next tax year.

If you do want to make the switch, your company will need permission from the IRS. This can be a lengthy process, but it will be worth it for the sake of your investors, inventory or potential growth.

First, file IRS Form 3115. Then, follow a multi-step process that includes the following:

- Add up accrued and prepaid expenses, including all the expenses you’ve billed for but haven’t received payment on yet.

- Add in your accounts receivable, including all unpaid customer invoices you need to add to your books.

- Subtract your cash payments and receipts. This could affect your previous period’s earnings, but you need to track it nonetheless.

- Subtract your prepayments. These turn into short-term liabilities until you deliver goods or services.

Finally, when filing your Form 3115, you need to attach your profit and loss statement and balance sheet from the previous year.

The process of transitioning accounting methods can be lengthy. But with the right accounting professional by your side, you can make the shift to accrual basis accounting as quick and painless as possible.

At Paro, we match clients with best-fit finance experts to achieve specific business goals. If you want to make the switch from cash basis to accrual accounting, let us help you find the right support you need with Paro’s accounting services.