An annual budget is great for benchmarking performance, but it’s just a target, not a prediction. Small and mid-sized businesses (SMBs) also need a more dynamic planning tool that can inform decision-making, especially in fast-changing environments.

As a result, the rolling forecast is becoming increasingly popular. According to Planacy’s latest State of Corporate Financial Planning Report, 30% of surveyed companies have adopted the technique as of 2025, up from 15% in 2022.

This guide explores what you should know about rolling forecasts, including what they are, how they differ from similar tools, and their decision-making benefits. We’ll also cover what you need to create one and some common mistakes to avoid.

What Is a Rolling Forecast?

A rolling forecast is a financial modeling technique that estimates future outcomes over a specific time horizon. Once the model is built, you periodically add actual results to it and extend your forecast to maintain the time horizon.

For example, say you create a 12-month rolling forecast at the beginning of 2026. When January closes, you incorporate the month’s results into your inputs and shift the end of the forecast window from December 2026 to January 2027.

Replacing forecast figures with real results is known as “actualizing.” Many businesses actualize monthly or quarterly, but the ideal cadence depends heavily on data availability. Using artificial intelligence (AI) to track activities in real-time helps support faster actualization.

Rolling Forecast vs. Budget: What’s the Difference?

A budget is an idealized financial plan that reflects how your business intends to operate over a fixed period. Typically, you build it before that period begins and leave it untouched throughout. It serves as a static benchmark, allowing you to compare your actual performance against original expectations.

A rolling forecast is a prediction that reflects how your business is most likely to perform over a certain time horizon. As time progresses, you continuously update it for actual results and adjust your prediction accordingly. It serves as a flexible decision-making tool, helping you anticipate risks and inform strategy.

Because they have such different purposes, businesses often use both types of forward-looking documents in combination. Budgets provide structure and accountability, while rolling forecasts support ongoing planning.

Rolling Forecast vs. Fixed Forecast

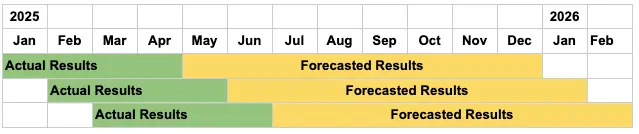

When discussing rolling forecasts, there’s often confusion around numerically named models like the “3+9 forecast” or the “4+8 forecast,” or simply a “5+7” or “6+6” approach. Under this convention, the first digit represents the number of actual results included. The second digit represents the number of months being forecasted.

In theory, you can take a rolling approach to these models by maintaining a consistent ratio of actual to forecasted months. For example, here’s how this would look with a 4+8 structure, actualizing monthly:

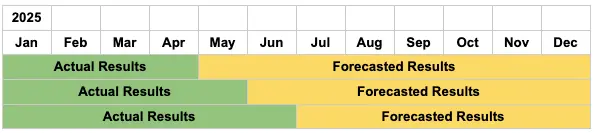

In practice, businesses more often cap these models at the fiscal year-end, building them to help managers keep a specific year on track. As a result, the forecast window steadily collapses—eventually resulting in an 11+1 view—like so:

In any case, businesses often benefit from a longer rolling forecast window than these structures support. The standard time horizon is at least 12 months into the future, regardless of where you are in the fiscal year.

Some businesses may extend this to 18 or 24 months when business cycles are longer or volatility is higher. However, estimates naturally tend to become less precise the longer the time horizon.

How Rolling Forecasts Improve Decision-Making

While budgets present an idealized version of the future, forecasts aim to show what’s most likely to happen. By focusing on expected outcomes rather than targets, they can help you identify risks in advance and address them before they materialize.

For example, say your income statement forecast suggests that margins will become increasingly compressed over the next six months. You could adjust your pricing strategy to help prevent the issue from affecting profitability.

Similarly, your cash flow statement forecast might reveal that you only have eight months of runway at your current burn rate. That would give you the time to cut spending or apply for financing before liquidity becomes an issue.

Rolling forecasts are especially valuable decision-making tools due to their use of fresh data. Traditional forecasts may rely on assumptions from months earlier, but rolling versions always reflect the latest performance and market trends.

They also maintain a consistent forward-looking time horizon. While fixed forecasts can create a planning cliff at year-end, rolling forecasts help you see into the next fiscal year as you progress through the current one.

What You Need to Run a Rolling Forecast

Running a rolling forecast is a complex practice that requires deep technical and financial expertise. Assuming you have the skills, here are some of the most important elements to assemble before you can begin:

- Clean data: Your past performance provides an essential foundation for predicting future results. You’ll need accurate historical data to generate an initial forecast and an efficient bookkeeping system to keep things rolling.

- Forecasting tools: Spreadsheets can work for some SMBs but often become hard to maintain as you grow. Dedicated software costs more upfront, but it can automate updates and reduce errors, potentially paying for itself in the long run.

- Core drivers: The accuracy of a rolling forecast depends largely on its drivers. Choose those you consider the most important for your financial performance. For example, that might be sales volume, churn rates or material prices.

- Clear assumptions: Rolling forecasts rely on performance and market assumptions, such as revenue growth rate and cost behavior. Make these as explicit as possible and revisit them regularly when new data becomes available.

- Forecast structure: Decide how far into the future you want to forecast and how often you can realistically actualize. These should depend on your industry’s volatility and the speed at which data becomes available.

Common Rolling Forecasts Mistakes SMBs Make

A rolling forecast can significantly enhance your decision-making capabilities, but only if you use it correctly. To help you benefit from the planning technique, here are some common mistakes to avoid:

- Treating forecasts like budgets: Rolling forecasts should be dynamic, not static like most budgets. Update them periodically while maintaining a consistent time horizon, even when the forecast window crosses into your next fiscal year.

- Overcomplicating the model: Don’t try to forecast every line item across all three financial statements. This can make your model slow to update and difficult to maintain, which often results in your finance team neglecting or abandoning it.

- Neglecting cash flows: Many businesses focus too heavily on revenue, costs and profitability. Forecasting your cash flow statement is just as important, helping you avoid shortfalls and liquidity strain.

- Ignoring external drivers: In addition to historical performance trends, rolling forecasts should incorporate external market factors. For example, that often includes customer demand and cost behavior.

- Sticking with manual methods: Manual forecasting processes are time-consuming and error-prone. Eventually, data entry and troubleshooting costs may justify the purchase of more advanced software.

Get Fractional FP&A Support Through Paro

Rolling forecasts help you consistently anticipate risks to your business. As a result, you can adjust your strategy preemptively instead of reacting to disruptions after they occur. This often has significant profitability and liquidity benefits.

However, maintaining a rolling forecast is no small feat, and SMBs often have limited financial planning and analysis (FP&A) teams due to staffing and budget constraints. In these cases, fractional FP&A support can be invaluable.

Need help structuring your forecast or translating it into operating decisions? Use Paro’s FP&A services to partner with an expert whose experience is tailored to your needs.