chapter 04

The Changing Faces of Finance Transformation

Assess your current talent and update job descriptions for the skills you need to lead with a future-forward mindset.

DOWNLOAD FULL REPORTBusinesses that have adopted AI are more likely to desire a future-forward leader. By contrast, 62% of businesses that don’t incorporate AI into their strategic planning are still prioritizing skills in accounting, controls and compliance—a traditional approach that leaves little bandwidth for strategic partnership.

We will see more and more

CFOs have data organizations

underneath them as

direct reports.

– Chase D., Paro FP&A expert

The CFO: Visionary Architect

The CFO will no longer be a cost gatekeeper to innovation, but a true driver of it. Finance leadership will need to build cross-functional relationships and bring in the right expertise to champion technology, like AI, and maximize use of company data.

FP&A: Insightful Storyteller

No longer a siloed function, FP&A will take reporting, budgeting and data analysis beyond the finance function in collaboration with other departments. Data credibility and analytics will be paramount. The analyst will help to establish credibility across the business, making data usable, accessible and actionable for the teams that rely on it.

Prioritize analytical skill gaps

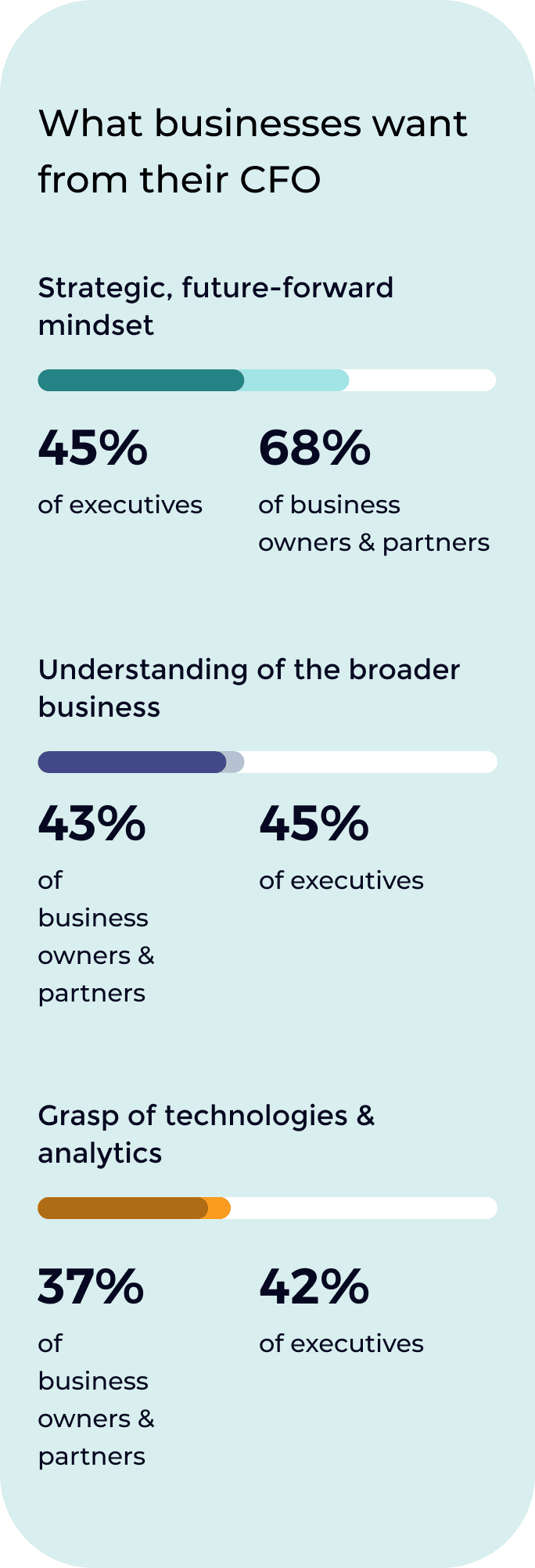

Senior leaders are in need of data and technical champions. A lack of trust in their data and an inability to turn data into insights are the top challenges for businesses—an indication of poor governance and analytical skills. They report the following as the most lacking skills within their teams:

Accountant/Controller: Automation Orchestrator

Accountants will not be replaced by digital transformation, but they will become the arbiters of these tools, providing domain expertise for AI model learning, preparing data and offering more strategic bandwidth.

Using AI and automation, accountants and controllers will incorporate greater risk management controls into processes, ensuring accuracy and compliance across the function. Exception-based management will be a key skill as automation replaces many standard, repetitive tasks.

Bookkeeping & Tax: Proactive Strategist

Bookkeeping has traditionally been a transactional role, but the future will require these professionals to assist in data quality and even project management during periods of system transformation.

These roles will become savings scouts, focusing on aligning tax approach with business strategy and uncovering new opportunities through data insights.

Next Steps for Your Finance Function

Ignite a cultural shift to data-driven, digital transformation.

- Think about how you can help each role answer the question, “What’s in it for me?”

- Build cross-functional teams to help develop intelligent solutions as a collective.

- Remember that ethical integrity and nurturing relationships are evergreen priorities that can’t be relegated to a tool.

Start thinking about change management.

- Solidify your strategic priorities and KPIs for your transformation.

- Identify who the drivers of change will be within your organization.

- Assess your talent pool. Consider your options for bringing your talent base up to speed, including outsourcing or reskilling.

Continue your own journey of independent learning.

- Read our related resources in the Paro Future of Finance Hub.

Uncover the Blueprint for Finance Transformation

Get all of the insights from the playbook to share with your team.

About the Future of Finance Survey

The Paro Future of Finance survey used online interviews conducted among members of the Vitreous World panel, with respondents representing US-based C-Suite executives or senior management in Accounting or Finance; the resulting sample was statistically representative.